EU gas storage levels now sit at over 90% full, however, market volatility endures due to inelastic supply/demand fundamentals

18th August 2023

In December we blogged about the world of gas storage (you can recap HERE). That blog highlighted how critical the Summer 23 storage injection season would be as Europe faced the first summer without overland pipeline supplies of 35-60 bcm from Russia.

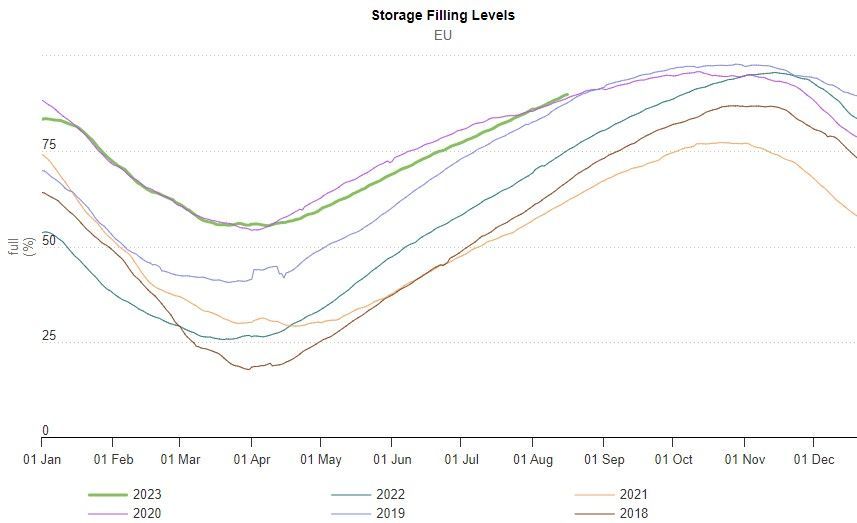

As of the 18th of August, the great news is that EU storage levels now sit at over 90% full; a level that has been reached far in advance of the mandated November deadline set by the EU.

Whilst gas and electricity prices have remained high by historical levels, with suppressed industrial demand across the continent, demand has admirably been met by various LNG cargo ships that have replaced the Russian supplies whilst day-ahead gas prices have averaging just 86 p/th (2.93 p/kWh) since March.

The excess supply and low prices witnessed has allowed market participants to ardently inject surplus gas supplies into storage, backed by the comfort of likely gains to be made on price arbitrage from storage withdrawals this coming winter. Under the Customers Warehouse Rule, European gas traders are now even routing supplies to Ukrainian storage facilities, which could accommodate a further 3.75 bcm this summer. The risks associated with using Ukrainian gas storage facilities are considered relatively low given all facilities are located at depths of between 0.4 - 2 km below the surface and have multiple injection and withdrawal points; none of which can be damaged at the same time.

Whilst this is all very good news, the global gas market is still finely balanced. Recent European price rises on the back of possible strikes at LNG facilities in Australia keenly highlight the interconnected nature of the world market, with the European Title Transfer Facility (TTF) price comparisons with the Japan Korea Marker (JKM) regularly dictating the direction of travel for LNG cargoes at sea.

We head towards Winter 23 with the confidence of storage levels being higher than anyone could possibly have hoped for whilst the sun is still shining. However, we are still not out of the woods, as the market shows continued high levels of volatility. We will all be keeping our fingers crossed that El Nino doesn’t bring a severe winter and there are no unforeseen outages to supply infrastructure across the continent.

Adalta Energy understands this is still an uncertain time for UK business. If you have any questions or require any assistance, then please contact enquiries@adaltaenergy.co.uk or call Ed Butler directly on 07989 431184. Alternatively, if you are an existing Adalta Energy client then please speak directly with your dedicated contact.