Commodity prices - where is the floor and why?

2nd February 2024

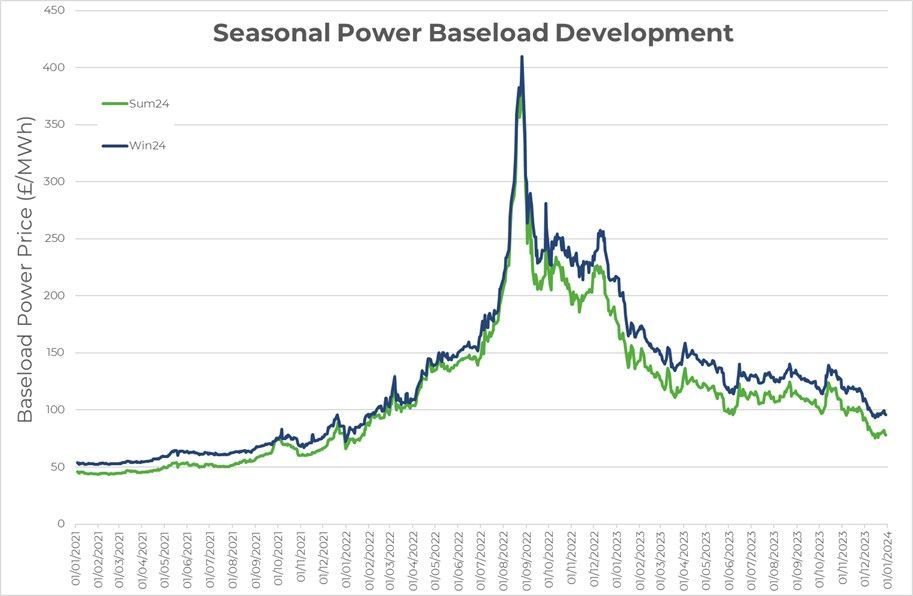

Since the peak of the energy crisis back in August 2022, barring the odd knee-jerk reaction to a short-lived bullish news story, the trend has very much been bearish, with prices falling both faster and further than any commentator had been predicting. As a result, the question has now moved to how much further prices could realistically fall and where the market will settle for a ‘new normal’ to be established.

Before the escalation in tensions between Ukraine and Russia, the market had ticked along steadily at an accepted annual norm around £50/MWh for some time. Since the turn of the year, the annual figure has traded as low as £71/MWh, still a £21/MWh premium when compared to pre-crisis levels, but certainly back to a level that is verging on acceptable for consumers following such a tumultuous period.

It is generally accepted that we will never fully return to pre-crisis levels with existing infrastructure. Firstly, because Europe is now dependent on LNG cargoes instead of pipeline gas from Russia, with LNG inherently more expensive than piped gas due to the high costs involved with liquefaction and re-gasification as well as the cost of shipping. Secondly, high levels of inflation have been present since the crisis, which inevitably led to commodity prices rising due to the increased costs involved in production and distribution.

Recent Contract for Difference (CfD) strike prices set by the government for offshore wind projects have been cited as a possible guide to a floor for the UK; with a strike price of £73/MWh being deemed to be an acceptable minimum price to encourage the further transition away from fossil fuels generation sources. Based on current spreads, this might broadly equate to a Summer contract of £65/MWh and a Winter contract of £81/MWh.

The outlook for 2024 continues to be generally bearish, driven by stagnant economic demand, strong storage levels, new renewable generation, and an ever-increasing number of secure LNG supplies and processing infrastructure developments across the continent. However, the ever-present geopolitical risks continue to add premiums to contracts, with recent painful lessons teaching us that prices have the potential to rise by a lot more than they can fall. As such, now is certainly a time when consumers can begin to consider whether they hedge prices further out than the short-term horizons that were successfully used to ride out the crisis.